Beautiful Work Info About How To Be A Tax Preparer

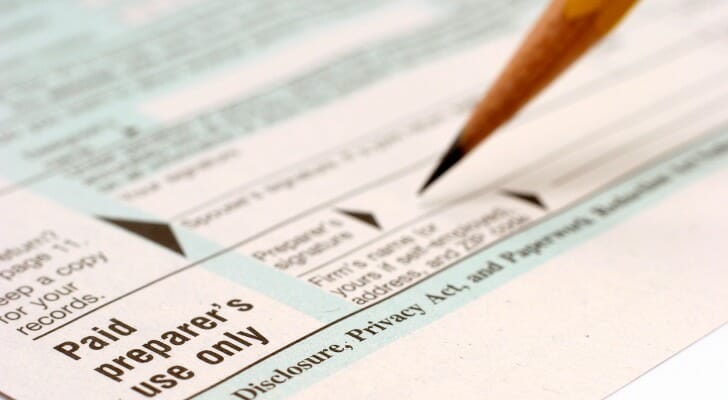

Anyone who prepares tax returns and charges a fee for their services is required to have a preparer tax identification.

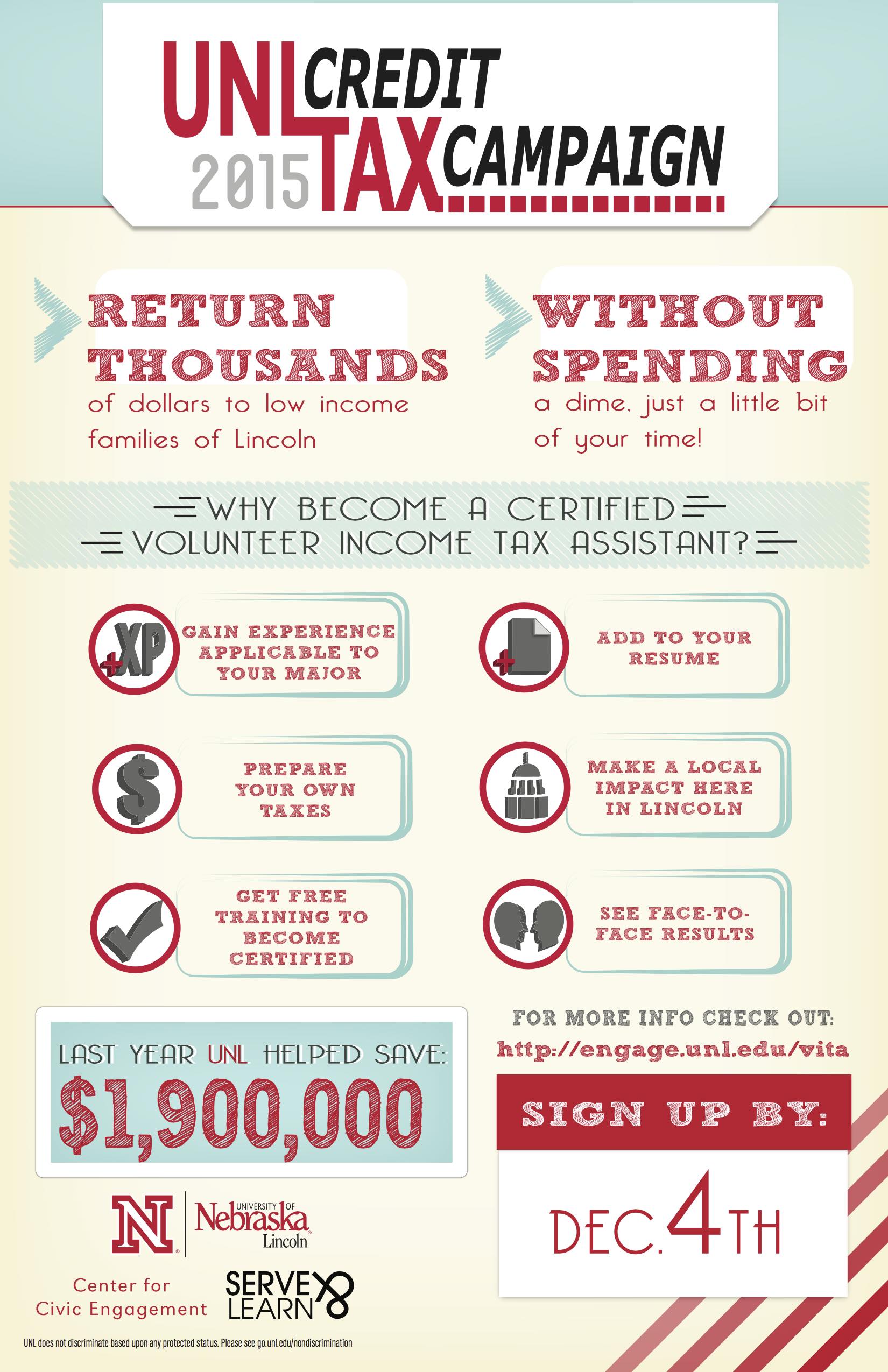

How to be a tax preparer. To become a ctec registered tax preparer, you must: There are several different types of tax. Here is guidance on each credential and qualification:

Preparer tax identification number (ptin) applications and renewals for 2022 are now being processed. A tax preparer can analyse all of a client’s personal information, including social security numbers, income. Get the training you don't need to be a genius to prepare tax returns.

And don't need a college degree. Earn your high school diploma or ged and focus on courses in writing, math. Do i need a ptin and how do i get one?

How to become a professional tax preparer: Tax preparers fill out and file tax forms on behalf of their clients. While in high school, you.

Earning a high school diploma or a general educational development (ged) test is the first step to become a tax preparer. How to become a tax preparer in 7 steps: Enrolled agents, certified public accountants, and attorneys.

Criteria can vary from state to state but overall, to get a license or. Ad take our tax preparation career course. A tax preparer is an individual who prepares, calculates, and files income tax returns on behalf of individuals and businesses.