Top Notch Info About How To Build Corporate Credit

It starts with how your business is set up.

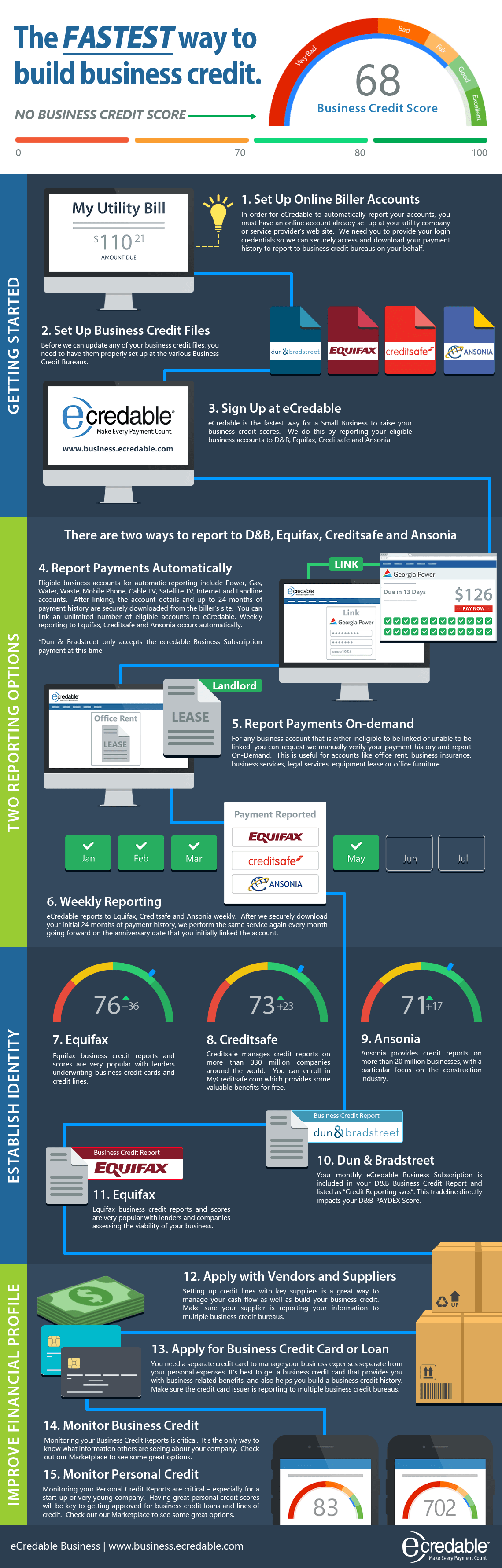

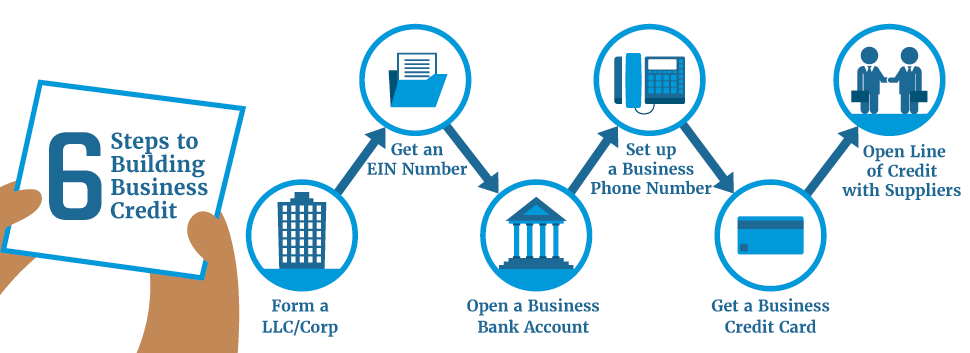

How to build corporate credit. There are several steps you can take to begin building business credit: Once you're all set up with a registered business, you can start building your credit score. How to establish and build business credit in 9 steps.

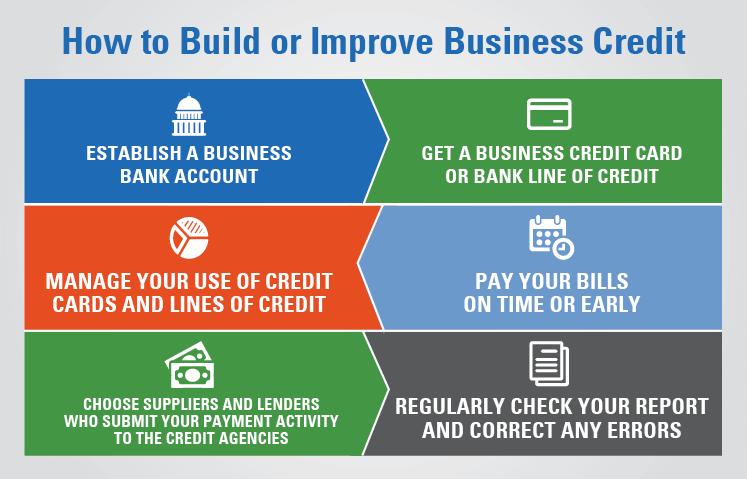

However, using your own credit could put you at risk if your business is ever in trouble. By decreasing the balances on your business credit cards, you can make a positive impact on. Here are several best practices that may be able to help you build your company's business credit file.

Up to 20x higher limits. Apply for a business credit card. The average interest rate is 16.17% (based on.

Many small business owners use personal credit to run their business. Business credit cards give small business owners the opportunity to build their credit scores, as well as earn valuable rewards on their everyday purchases. No fees of any kind.

The only corporate card and spend management platform designed to help you spend less. Unlike personal credit, corporate credit does not build passively on its own. If your business is not set.

You can start to build your business credit by forming an entity, getting an ein number, opening a bank account for the new company, and establishing trade and credit lines with creditors. Now we have made it. So, what do you need to do to start establishing business credit for your startup venture?