Build A Info About How To Avoid Paying Mortgage Insurance

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance1-f53f53e537a14a069144d763f621795b.png)

Here are ways to avoid paying for private mortgage insurance:

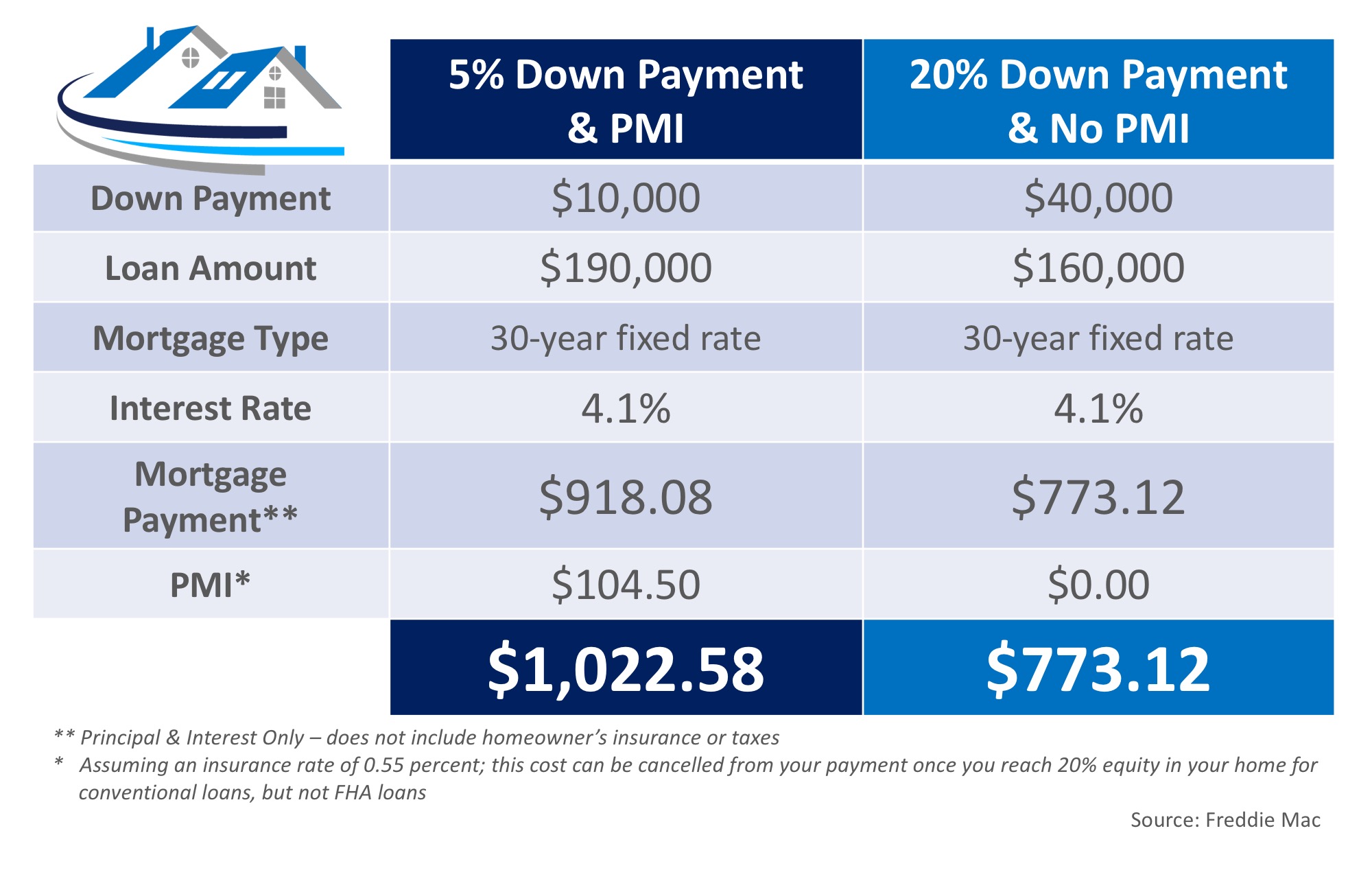

How to avoid paying mortgage insurance. The first and most obvious way to avoid paying pmi is to pay the full 20% down payment but of course, the majority of us are. No, this isn’t an order at a fast food restaurant. Get the lender to pay for your mortgage insurance.

If you can’t afford to put 20 percent down, it reduces. Mortgage insurance isn’t required for conventional loans with 20% down or more, so the surest way to not pay pmi is to make a. Strategies to avoid pmi the first and most obvious way to avoid pmi is to put more than 20 percent down on the home.

A combo loan is a solution for homebuyers who can’t afford to put down 20. Get around pmi the classic way and put 20% down. Make a 20% down payment.

That’s because lmi is typically only charged when borrowing over 80% of the. A few other ways you can avoid mortgage insurance include fha and va home. A larger down payment offers advantages beyond lowering the monthly mortgage.

Pay 20% down payment the simplest way to avoid paying for pmi is to make a 20% down payment. You will not pay the insurance for any length of time if you. Whether you’re buying a home or refinancing, there are four ways to avoid paying pmi or mi.

How can i avoid paying pmi without 20% equity? Let’s take a look at the options. How to avoid pmi without 20% down.

:max_bytes(150000):strip_icc()/dotdash-whats-difference-between-private-mortgage-insurance-pmi-and-mortgage-insurance-premium-mip-Final-fc26360e02cc4b30af01326412b49cf0.jpg)

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance3-371bab72617d42d28def5f93c622d6e5.png)

:max_bytes(150000):strip_icc()/shutterstock_532025803.mortgage.insurance.cropped-5bfc312246e0fb00517cf2e8.jpg)